|

$56 Million in Real Estate with Nick Earls and Eric DiNicola, Winterspring Capital

Welcome to Owner Operated.

This week I spoke with Nick Earls and Eric DiNic0la, co-founders and managing principals of Winterspring Capital and co-owners of PWN Development based in the Greater Boston area.

Listen to this week's show on Spotify, Apple, and Google Podcasts.

Winterspring Capital is a real estate syndication firm with a portfolio of $56 million in multifamily assets under ownership throughout the Southeast and Boston.

We covered:

- Getting started in real estate development

- Balancing development of proper with long-term hold investment properties

- Self-funding deals vs. raising capital

- Real estate syndication: 506B vs. 506C rules

- Buying real estate under LLCs vs. starting a real estate fund

- Hiring and managing sub crews and employees

- Handling partnership disagreements and best practices

- Don’t blame people. Even if it’s someone else’s fault

- The benefits of stoicism for small business and real estate professionals

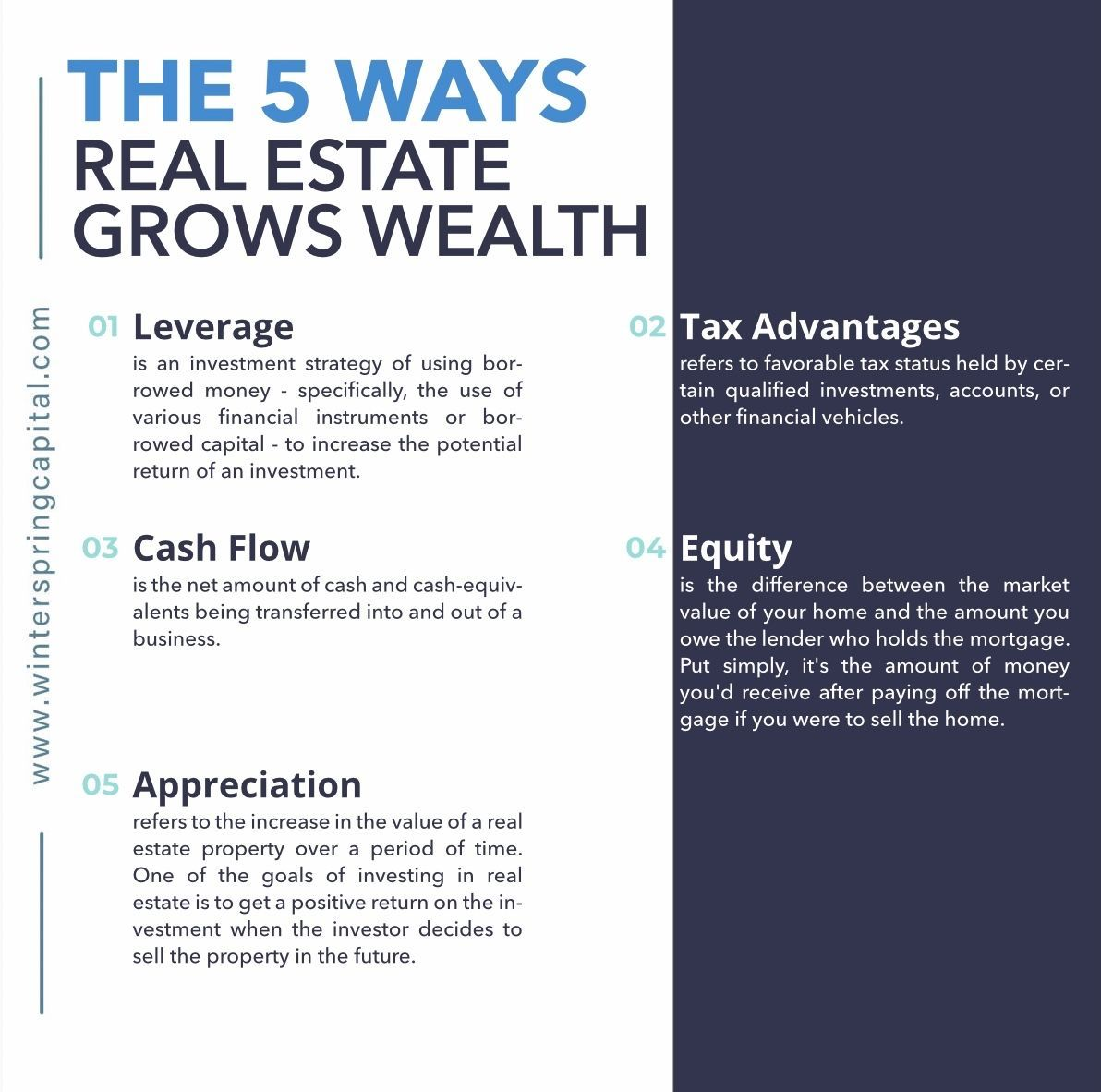

- Dealing with inflation through investing in real estate

- Fractional ownership of properties through investing in real estate syndications

- Why you should call local lenders before large banks

- DTI (Debt-to-Income) Ratio when starting out in residential real estate

- "House Hacking" as a way to get into real estate investing

- How to protect yourself as a small business owner